This service is generally offered when the underlying administrator is Blue Cross Blue Shield/Anthem, United Healthcare, Aetna, Cigna, or Humana (i.e., BUCA carrier) and where the Pharmacy Benefit Manager (PBM) is either carved-in or carved-out.

Since the BUCA carriers generally are not filing stop-loss claims, SBR will provide full filing services monthly, including:

Individual Claims, Aggregate Claims and Individual 50% Notice Filing

This service is generally offered when the underlying administrator is Blue Cross Blue Shield/Anthem, United Healthcare, Aetna, Cigna, or Humana (i.e., BUCA carrier), when the PBM is bundled with the BUCA administrator and when the stop-loss carrier is automatically receiving a global, multi-policyholder claims data file from the BUCA administrator.

This service is very similar to our stop-loss claims filing and reporting service. The only difference is we do not file an actual claim, however we facilitate the process to ensure a timely and accurate reimbursement of stop-loss claims monthly. This service includes:

Individual Stop-Loss Claims Tracking and Review

This service is generally offered when the underlying administrator is a traditional third-party administrator (TPA) and the TPA is performing the stop-loss eligibility verification, claims filing, tracking, and reporting function. The purpose of this service is to perform a review, either quarterly or annually, to ensure the stop-loss claims are being filed and adjudicated according to the stop-loss policy terms. During this review, SBR will compare the stop-loss claims filed and reimbursed with the stop-loss carrier to other source claims reporting. At the end of the review, SBR will provide a report summarizing the findings. If large discrepancies are uncovered during the review, the SBR claims team will conduct further research and work with the TPA and stop-loss carrier to resolve any discrepancies.

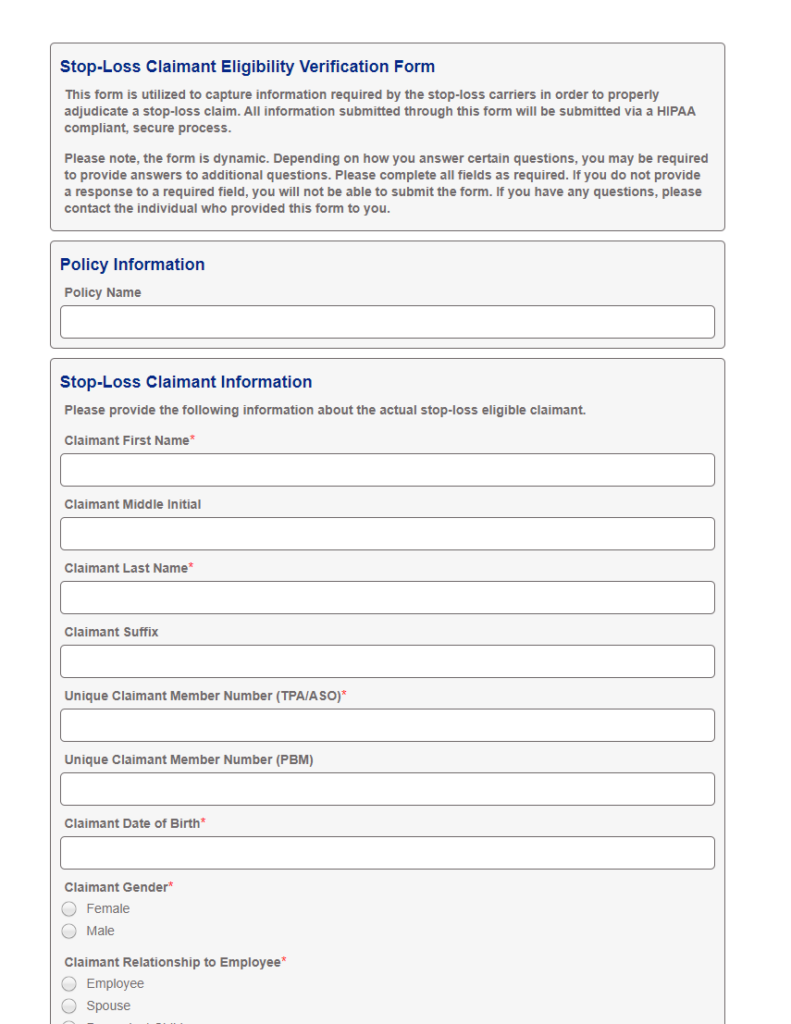

SBR has developed a proprietary, secure, HIPAA compliant, rules-based web form that ensures the required information is completely and accurately provided by the authorized verifier. In addition, our claims team reviews all forms to proactively address potential gaps or discrepancies between the responses on the form and the eligibility rules within the plan document.

Once a claimant exceeds 50% of the individual stop-loss deductible and is close to becoming an actual claim, the SBR claims team will proactively email the authorized eligibility verification contact on file with a URL link to our secure, HIPAA compliant, rules-based web form and instructions on completing the form. Our claims team will pre-fill the form with information we already have on file for the claimant. Once the form is completed, the information is updated within our systems real time and our claims team will review the information provided to ensure there are no potential gaps or discrepancies between the information in the form and the eligibility rules within the plan document. Once reviewed and approved, the eligibility verification information is sent electronically to the stop-loss carrier.

When managing stop-loss claims, there are different methods utilized to get access to the information needed in order to properly manage a stop-loss claim, identify opportunities for implementing cost containment strategies, and provide back-end financial and clinical reporting including aggregate stop-loss reporting. Some of these methods include: