A stop-loss optimization and decision support tool

Utilizing our proprietary stop-loss optimization tool and algorithms, we can help you and your clients better understand self-funded health plan risk and determine optimal levels of risk retention and risk transfer.

Whether it is Aggregate Stop-Loss (ASL) or Individual Stop-Loss (ISL) insurance, we can provide you and your clients with a decision support tool to help select the optimal level of risk transfer based on where the insurance markets are pricing risk transfer premium.

We take the guess work out of which stop-loss insurance solution is right for your clients.

Individual Stop-Loss (ISL) Analysis

What deductible level is optimal? Should an aggregating deductible be used?

Which carrier offers the best risk transfer solution?

Which contract basis is right?

What is the probability of high cost claimants?

What is the probability that reimbursed claims will exceed premiums paid?

Are the individual stop-loss premiums within a normative range?

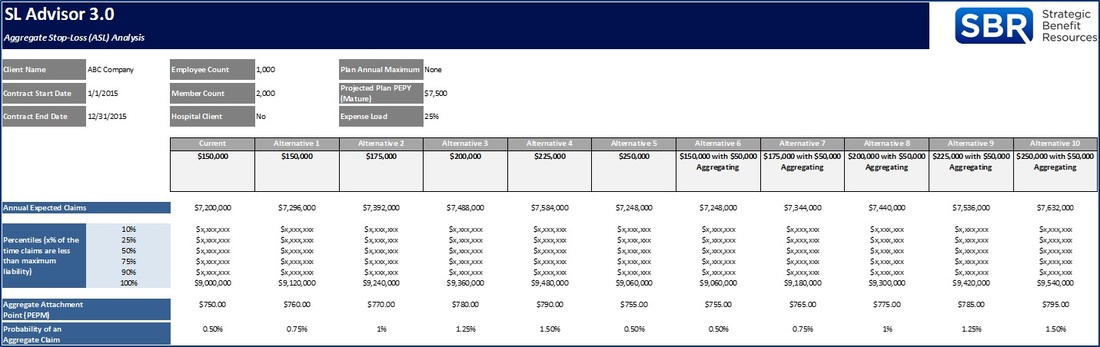

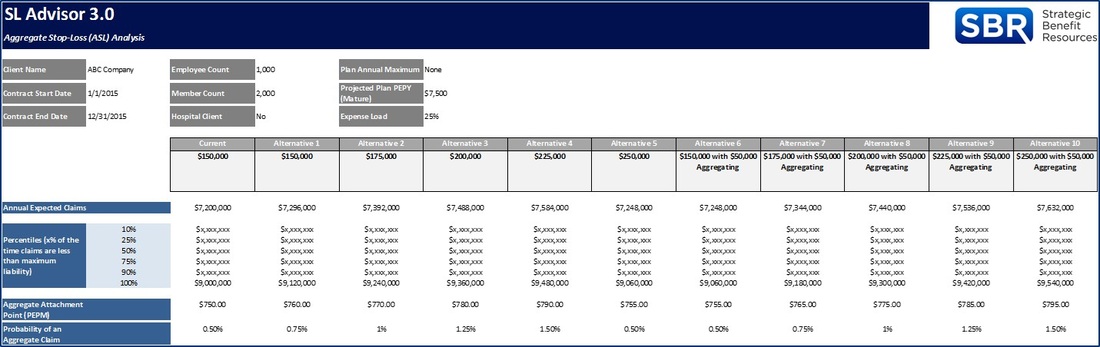

Aggregate Stop-Loss (ASL) Analysis

What is the probability of having an aggregate claim?

Should aggregate stop-loss insurance be purchased?

What is the range of exposure and the probability of each event happening?