As a fully licensed and bonded third-party premium administrator, SBR Administrative Services provides full premium administration services including:

Premium/Fee Invoicing

Premium/Fee Collection

Premium/Fee Remittance and Commission Remittance

SBR’s Premium Administration Services can accommodate any of the following types of fees and pay any vendor(s) as needed:

% of Premium (Gross or Net)

Per Employee Per Month (PEPM) – Composite or By Coverage Tier

Flat Dollar Amount Per Month

SBR’s premium administration service ensures fast and accurate payments to carriers, brokers and vendors, while also providing an additional layer of quality control. This service is offered at no additional cost.

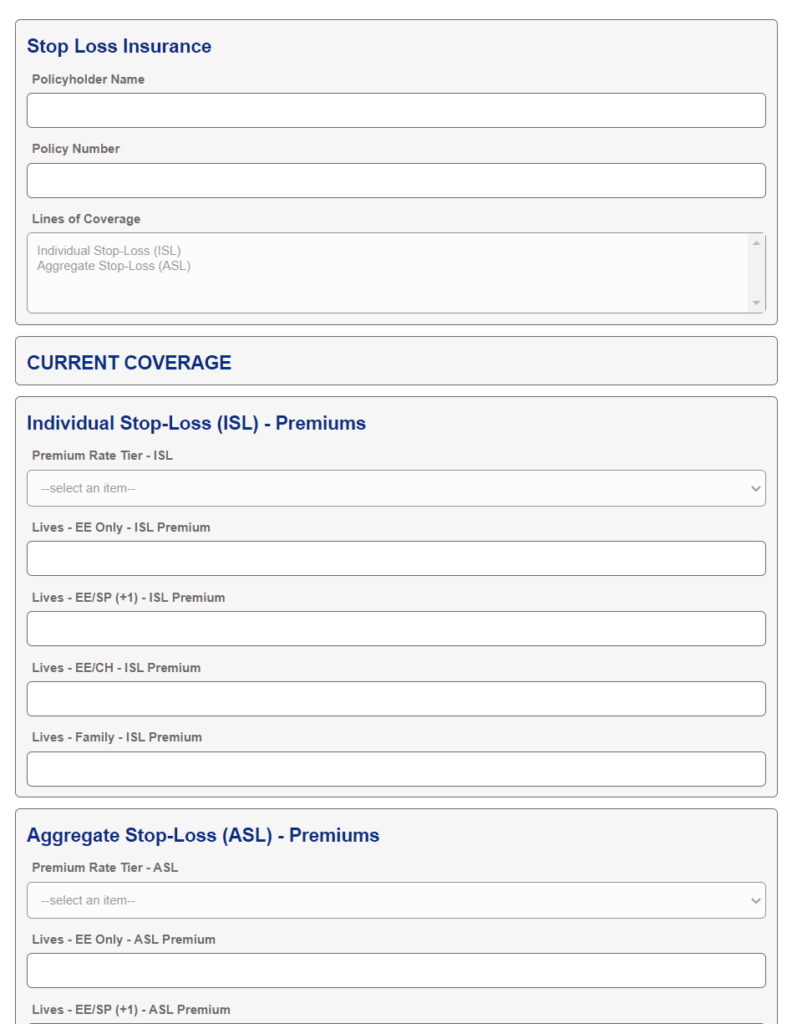

Initial Email – Fifteen (15) days prior to the premium due date, the primary premium administration contact on the policy will receive an automated email with a link to a secure web-based form that will allow the recipient to provide the covered employee lives by line of coverage and by coverage tier for the current month as well as adjustments for the prior month.

Reminder Email(s) – A reminder email will be sent every seven (7) days if the form has not been completed and submitted.

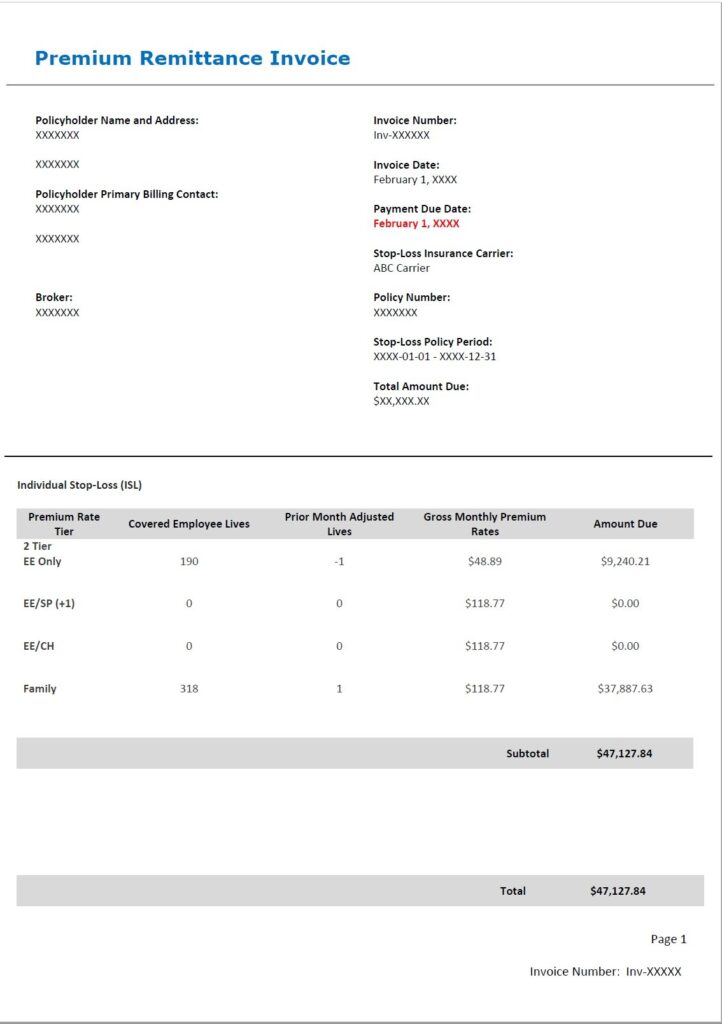

Once the web-based form is completed and submitted in step 1 above, the premium invoice will be auto-generated and sent via email to the primary premium administration contact listed on the policy, as well as any secondary premium administration contacts listed on the policy. The invoice will include payment instructions for paying premiums either via ACH/direct deposit (preferred) or paper check.

Failure to pay premium within the grace period of the actual stop-loss policy could cause a policy to lapse, please refer to the actual stop-loss policy for details regarding grace periods and premium payments.

Once the gross premium payment has been received from the policyholder and applied to the invoice, an accounts payable will be created for any payees listed on the policy (i.e. carrier (net premium), brokers (commissions) and/or any third-party vendor fees (vendor fees)).

Net premiums, broker commissions and vendor fees will be batch processed on the 25th of the month for all accounts payables created after the 25th of the prior month.

Payments will be processed through our payment vendor, Bill.com, for each payee based on the payment information (i.e. ACH/direct deposit or paper check) we have on file at the time of the payment.

A detailed itemized statement for each payment will be sent via email to each of the recipients we have the on file for each payee.